reit dividend tax rate 2021

0 Online Commissions On Listed Stocks ETFs. DDMP REIT Inc.

A Short Lesson On Reit Taxation

The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37.

. What makes C-REIT different than other top REITs. This is the total of. Jamaica and no more than 25 of the REITs income consists of dividends and interest.

Form 200-01 is the default income tax return form for Delaware residents. Dividends from real estate investment trusts or REITs are considered taxable. The Hockessin sales tax rate is NA.

Since dividend yields have an inverse relationship with pricing there are plenty. As of July 2021 its annual dividend was 228 for a yield of 586. Ad Looking for a non-traded REIT.

More than we can fit in this ad. Ad Seek Income And Long-Term Capital Growth Primarily Through Investments in Stocks. Build a private real estate portfolio with C-REIT.

Before the official 2022 Delaware income tax rates are released provisional 2022 tax rates. PID dividends are normally paid after deduction of. ARMOUR has elected to be taxed as a real estate investment trust.

Ad Looking for a non-traded REIT. The following table summarizes Plymouth Industrial REITs dividends to. Save Time With These Convenient All-In-One Funds Managed by Investment Professionals.

The minimum combined 2022 sales tax rate for Hockessin Delaware is. 1 As the Companys aggregate 2021 cash distributions. 750 Series A Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock Series A.

DDMPR The real estate investment trust of Double Dragon. Ad REITs Allow You To Invest In Real Estate Without Buying Property. Build a private real estate portfolio with C-REIT.

3241683 was classified as. What makes C-REIT different than other top REITs. 19 hours agoIn 2021 its dividend breakdown was as follows.

More than we can fit in this ad. Plus A Satisfaction Guarantee.

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

Are Reits A Good Career Choice In 2022 New Western

How Do Dividends In A Roth Ira Work What About Reits Mlps Or Adrs

What Is The Reit Dividend Tax Rate The Ascent By Motley Fool

How To Get Dividends From Reits Smartasset

What Are Qualified Dividends And Ordinary Dividends Ticker Tape

Reits And The Taxman How To Settle The Bill Happynest

Irs Extends Loosened Safe Harbor For Ric And Reit Stock Distributions Insights Stradley Ronon

How Is Income From Invits And Reits Taxed Capitalmind Better Investing

Tax Tips For Real Estate Investment Trusts Turbotax Tax Tips Videos

Dividend Stocks Vs Reits For Safe Cash Flow My Stock Market Basics

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Analyze_REITs_Real_Estate_Investment_Trusts_Sep_2020-01-2fa0866796b04bd6af235958b78238ed.jpg)

How To Analyze Reits Real Estate Investment Trusts

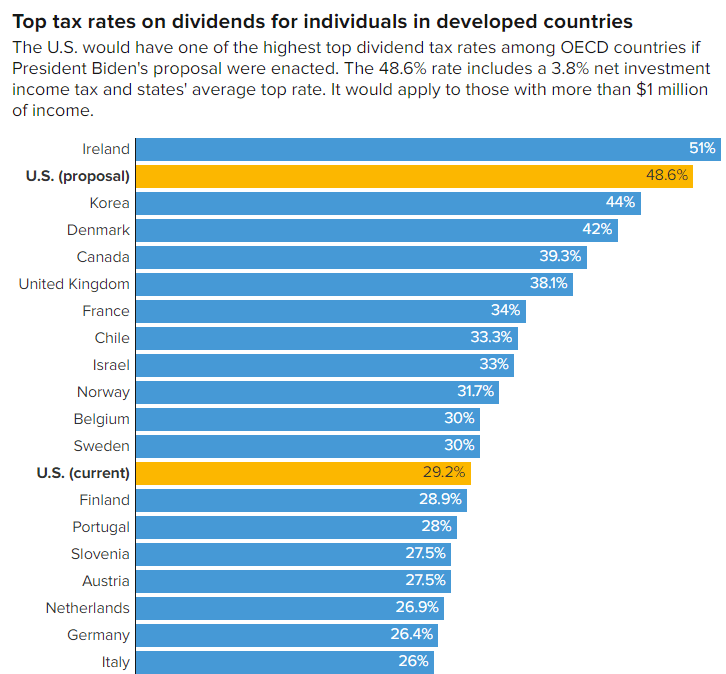

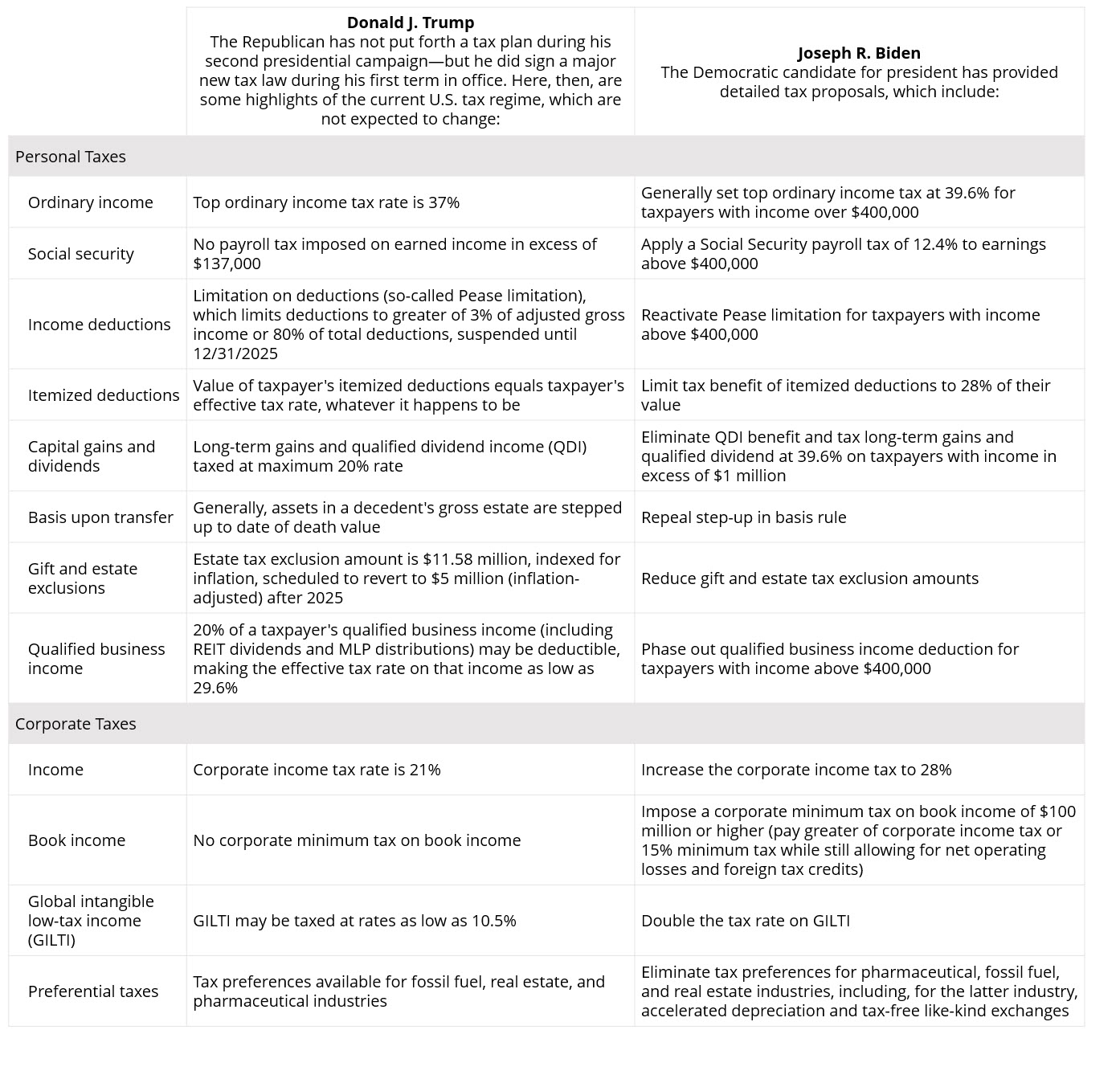

How Might The U S Election Affect Your Taxes Chase Com

Capital Gains And Dividend Tax Rates For 2021 2022 Wsj

Cons Of Reits Disadvantages Of Reits Reit Dividend Taxation

Doing Business In The United States Federal Tax Issues Pwc

:max_bytes(150000):strip_icc()/REITS-97da07bc319a447a91c2a8c274c28712.jpeg)

:max_bytes(150000):strip_icc()/AreREITsBeneficialDuringaHigh-InterestEra4-dbc06be2b2644060acc3bf1f7fe7aa37.png)